For most people, making smart financial choices often requires more effort, time, or self-control, and is frequently less pleasurable in the moment. How can plan sponsors and advisors encourage people to make better financial choices, when these are usually not the most immediately appealing option?

One traditional solution has been to use some kind of incentive to reward the desired behavior. At first glance, incentivizing behavior seems reasonable. Many wellness programs, including financial wellness programs, use some kind of incentive to encourage program engagement and participation. But do incentives work? And is there a downside to incentivizing behavior? The surprising answer is that while incentives often do work short-term, they can end up de-motivating employees over the longer term. Here’s why.

What we know about motivation

Researchers have studied motivation for decades, in an attempt to understand why people behave in the ways that they do. One of the most important things we’ve learned is that there are two basic types, intrinsic and extrinsic. It’s the difference between “I want to do this” (intrinsic) and “I have to do this” (extrinsic). Both intrinsic and extrinsic motivators have a role to play in encouraging more positive financial behaviors.

Rewarding employees for participating in a voluntary benefit program is a type of extrinsic motivation. Contrary to popular belief, rewards in and of themselves don’t necessarily decrease intrinsic motivation. Situations that involve boring, routine or tedious tasks can often benefit from the use of rewards–because there is little intrinsic motivation around such tasks to begin with. But many researchers agree that rewards simply for participating in a task are likely to reduce intrinsic motivation, because these do little to encourage a sense of individual competence or autonomy.

So how can plan sponsors motivate plan participants more effectively? A range of incentives are often used to attract employee participation with wellness benefits. Small, intermittent rewards, such as being entered into a randomized drawing for a gift card once a task is completed, are often just as effective as larger ones, unless the reward is very, very large. In some cases, a large incentive can be interpreted to mean that a desired behavior is difficult or unpleasant, or it can seem coercive, which can actually decrease employees’ intrinsic motivation to change by reducing their sense of autonomy. Small incentives can often serve to increase attendance or completion of a program, but then once the incentive disappears, so does the behavior. So these are better used for one-time actions, rather than to foster new habitual behaviors.

In terms of more intrinsic motivation, there are several strategies plan sponsors can use to encourage participants to want to make better financial choices. Intrinsic motivation is inherently rewarding and lasts longer over time. For example, helping people to discover and strengthen their own intrinsic motivation to stop addictive behaviors is the basis of motivational interviewing, an effective therapeutic approach that has been used successfully for tobacco cessation.

Employers can build on plan participants’ existing motivation by supporting people to focus on their own short and longer term personal financial goals, to persevere in the face of challenges, and to build confidence that they can achieve those financial goals. Setting a personally meaningful goal, along with tracking and celebrating progress toward it, can make it easier to resist the impulse to overspend day-to-day by transforming ‘I have to deprive myself of this’ into ‘I want to put my money toward that instead of this.’ In other words, let’s encourage people to spend money on what brings them the most happiness—not just superficial entertainment, but real deep-down satisfaction. Identifying the smaller steps needed to meet a goal, and celebrating the ‘win’ as these steps are completed are also ways to build the confidence that change is actually possible. The positive emotional as well as financial effects of successful behavior change can also help keep employees motivated to continue good financial habits.

Another strategy is to simply inform people of the choices their peers are making, based on our natural tendency to compare ourselves with those around us, and do what others are doing. The United Kingdom’s Behavioural Insights Team (BIT) has used this strategy successfully to get more people to pay their taxes on time. The BIT is a public-private partnership, focused on making public services more cost-effective and easier for citizens to use, and enabling people to make better choices for themselves through the use of ‘choice architecture’.

To encourage people to pay their taxes on time, BIT simply changed the wording of letters sent to taxpayers from the Inland Revenue, the UK equivalent to the IRS. Adding a true statement that ‘most people pay their tax on time’ turned out to increased compliance from 33.6% to 35.1%. Adding another statement that ‘most people in your area have paid their tax and you are one of the few that are yet to pay’ increased compliance to 39%, bringing in millions in unpaid taxes at almost zero cost.

A key component of the idea behind choice architecture is to help people create habits and systems so that it’s easy to follow through on decisions. Auto-escalation of 401(k) contributions is a good example. Employees looking to build better habits can be also encouraged to anticipate potential stumbling blocks, and create a plan to handle those, should one occur. Psychologists refer to this as an ‘if/then’ strategy, or “If a happens, then I’ll do b.” Mentally rehearsing a plan of action in advance can make it easier to follow through.

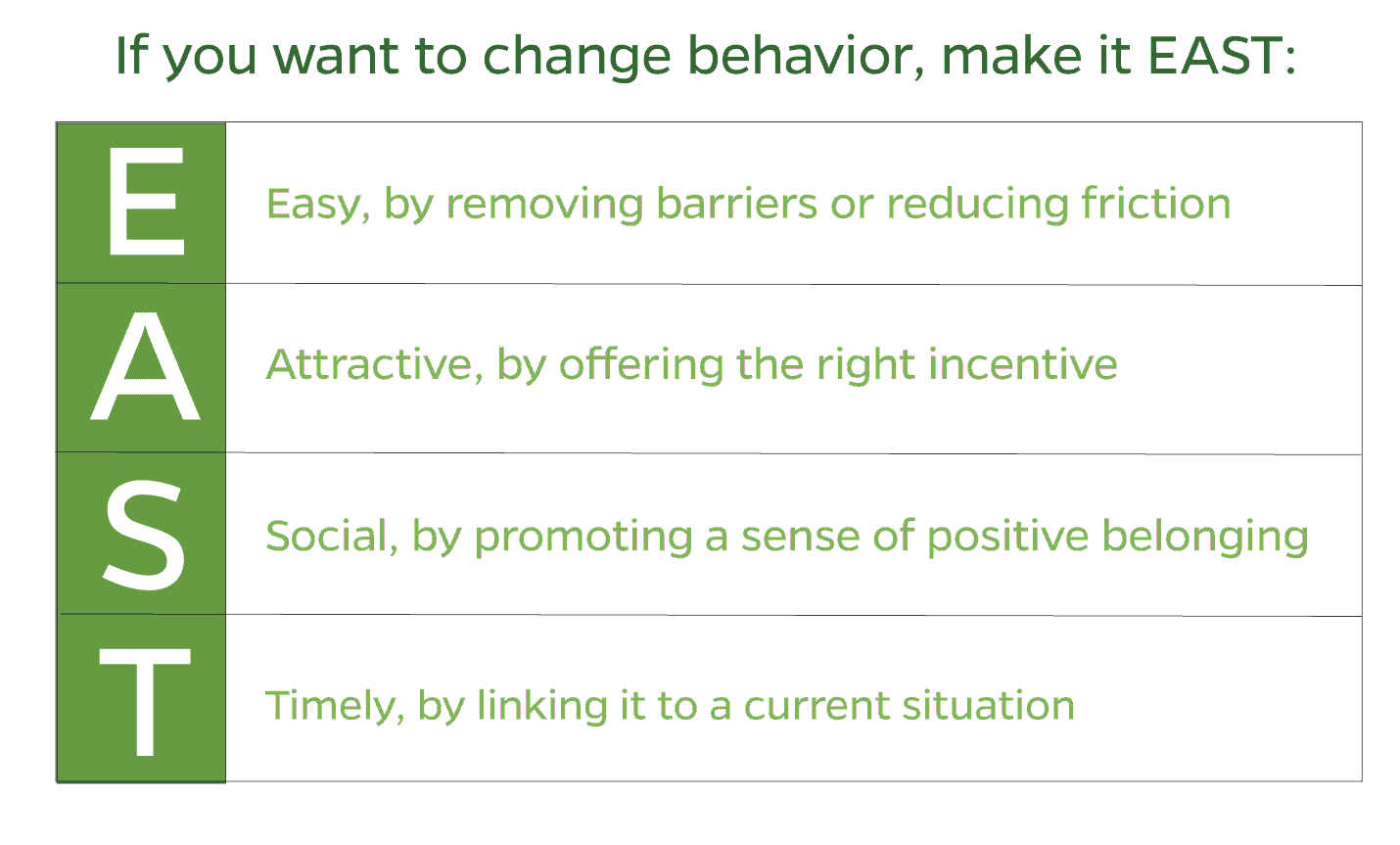

BIT has published a framework for applying these behavioral principles. It’s based on the idea that if you want to encourage a behavior, make it easy, attractive, social, and timely—EAST. The framework is based on the company’s own research combined with insights from the wider academic literature. The principles are straightforward: